Do you want to know the importance of diversification in your investment portfolio?

If yes, then from this article you can learn how spreading your investments across various assets can manage risk and enhance returns and what is the Importance in Your Investment Portfolio

In this blog post, we will cover all the major as well as minor points regarding to diversification of our Investment portfolio and why it is very important for us, after reading this article you will able to know all your doubts regarding our Investment portfolio

Diversification is a way of hedging your risks by spreading your investments across different types of assets. The idea is that by investing in multiple investments, you can achieve better returns and reduce risk compared to a single investment.

What is Diversification?

Diversification is a technique used to manage risk in the stock market by distributing investments among a variety of asset classes and investment vehicles.

People exactly don’t know What it means to diversify your investments and here is a simple definition for that. The theory behind having a variety of investments is that the bad performance of one is likely to be countered by the good performance of other investments, lowering overall risk.

In this manner, the loss on any one investment is lessened, which helps shield the portfolio as a whole from large value declines.

To lower risk, diversify your investments by distributing your funds over a variety of stocks and other assets. Research indicates that the best defense against risk comes from a portfolio consisting of 25 to 30 distinct stocks. Although the additional benefit diminishes, adding more equities might still be beneficial.

The theory is that if certain investments decline in value, others may increase in value, creating a balance. This is most effective when the investments respond to changes in the market in different ways from one another.

Also Check:

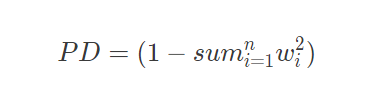

Portfolio Diversity Formula

To maintain the diversification ratio in Your Investment Portfolio, there is one formula created by some expert investors that formula will definitely help to do diversification of your investment portfolio.

This formula is used to calculate the portfolio diversity score:

Where,

- PD is the portfolio diversity score

- w_i is the weight of the i-th asset in the portfolio

- n is the total number of assets in the portfolio

Square each asset’s weight in the portfolio, add together all of the squared weights, and then deduct the total from 1 to determine the portfolio diversity score. The portfolio diversity score is represented by the resultant value, where larger values denote greater diversity.

Reference site for this formula, to study in details

Diversified portfolio example

To understand the diversification of an Investment Portfolio, Let’s see the examples of an investor who initially solely owns American equities and has a diverse portfolio. They can add foreign equities from regions such as the UK, Europe, and other parts of Asia to diversify.

In this manner, the risk is dispersed over several markets. Additionally, it implies that the investor will profit from the stability and progress of different regions.

Investors are less vulnerable to regional currency fluctuations or economic issues when they have investments across multiple regions and currencies. As a result, the investment portfolio is more profitable and balanced.

Types of Diversification

When investing, diversification refers to distributing your funds among various avenues:

- Asset Types: Putting money into cash, stocks, bonds, properties, and commodities.

- Industries: Investing in many sectors such as consumer goods, consumer goods, healthcare, and technology.

- Locations: To balance the risks associated with various economies, invest in both domestic and foreign markets.

- Company Sizes: To diversify risks associated with company size, purchase stocks from small, medium, and large companies.

- Timeframes: Allocating funds to meet immediate demands, mid-term objectives, and long-term plans in order to account for potential future needs.

These techniques can potentially raise your investment returns while lowering your total risk of losing money.

How is asset allocation different from diversification?

Two essential investment management strategies are asset allocation and diversification, each with its own functions. Asset allocation is the process of allocating investments strategically among several asset classes, such as cash, stocks, bonds, and real estate, taking into account the investor’s time horizon, risk tolerance, and financial goals.

Its objective is to ascertain the proper allocation of various assets within a portfolio in order to maximize risk and return.

Contrarily, diversification is distributing investments within each asset class among a range of securities, markets, sectors, and geographical areas.

This approach seeks to keep performance from being dominated by any one investment or class of investments, therefore reducing portfolio risk overall. The effects of market volatility and particular hazards related to particular securities or industries are lessened by diversification.

In conclusion, diversification reduces risk by distributing investments within certain categories, whereas asset allocation concentrates on dispersing assets across wide categories within a portfolio.

Diversification improves risk management within each asset class, while asset allocation sets the structure of the portfolio. Taken together, these two factors create a well-rounded investing plan that helps investors reach their long-term financial objectives.

Hope, that you will understand how is asset allocation different from diversification.

Also Check:

How does diversification work?

Let’s examine how the diversification strategy works to optimize long-term profits while also improving portfolio stability and risk management.

To reduce total risk and volatility, diversification involves spreading investments over a range of assets, sectors, industries, and geographical areas. By balancing underperforming assets with others that might do better or stay steady, it seeks to reduce losses.

Important diversification mechanisms consist of:

- Risk Management: By limiting your exposure to any one investment, you may lessen the effect of a bad investment’s performance on the overall portfolio, which helps you manage risk when the market is down.

- Stability Enhancement: A balanced mix that can sustain portfolio stability over economic cycles is ensured by the distinct ways in which different asset classes respond to market conditions.

- Potential for Returns: Diversification lowers risk while also providing an opportunity to profit from various expanding industries or geographical areas.

- Asset Class Allocation: To balance overall portfolio performance in reaction to economic events, assets should be spread over stocks, bonds, real estate, and commodities.

- Sector and Geographic Spread: Diversifying your investments reduces your exposure to particular economic or geopolitical risks and increases the durability of your portfolio.

In conclusion, diversification reduces exposure to market swings and creates a balanced portfolio for longer-term, steadier profits.

Also Check:

Benefits of Diversification in Investment

diversification of Investment is a strategy that reduces risk and increases returns Similarly, there are lots of benefits that you should definitely know. After reading this, you will understand why is diversification important

Risk Reduction

While investors frequently prioritize producing competitive returns, risk management becomes even more important during market downturns in order to minimize losses.

By distributing investments among a variety of assets, a diversified investing strategy lessens the impact of market volatility and aids in risk management Also, By assisting in the maintenance of a long-term portfolio position, this approach can raise the probability of reaching financial objectives.

It’s crucial to take into account variables like interest rates, inflation, the choice of particular securities, governmental and central bank policies, currency fluctuations, and time horizons while attempting to lower risk in an investment portfolio.

These risks can be mitigated by diversifying across a variety of asset classes, such as bonds, real estate, and infrastructure. It is important to steer clear of large investments in a single security and to comprehend the effects of economic policies and currency changes. A longer investment horizon can also help to reduce short-term losses, making the portfolio more stable and possibly profitable over time.

Potential for Enhanced Returns

Due to the diversified investment portfolio, the potential for larger returns can be possible which is one of the main advantages of the diversified investment portfolio.

Investing in several asset classes, industries, and geographical areas allows you to take advantage of numerous growth prospects. A successful market or sector may offset a struggling one, helping to balance the performance of your portfolio as a whole.

In this manner, you can profit from global growth, which will eventually yield higher returns. Additionally, diversification increases your chances of making larger profits by enabling you to benefit from emerging trends and developments across a range of industries.

Protection Against Market Volatility

By spreading your investment money between different types of investments, industries, and regions. you can able to reduce the risk of one bad market move ruining all your savings.

If one part of your investments does not perform well, others may do better, offsetting potential losses. This approach makes your overall investment more stable and able to handle market changes, so you’re more likely to get consistent returns and keep your financial goals on track.

Reducing Volatility

You will be able to reduce the risk as well as volatility that a downturn in one region will damage your entire portfolio.

If one part of your investments does not perform well, others may perform better, helping to offset the loss.

This strategy keeps your investment returns more stable over time, giving you more confidence that your long-term financial goals are protected against sudden market spikes.

Capitalizing on Market Opportunities

Diverse investment portfolios enable investors to take advantage of market opportunities more effectively, It can increase their chances of benefiting from a variety of market trends and economic conditions.

Reductions in certain sectors or locations can be offset by growth in other sectors, producing more evenly distributed earnings overall. This approach allows investors to seize new possibilities while mitigating the risk associated with excessive reliance on any one investment or market segment.

Thus, diversity helps investors to capitalize on favorable opportunities, adapt to changing market conditions, and potentially even raise their returns on investment over time.

Professional Guidance

By spreading their investments among a variety of asset classes, industries, and regions, they frequently consult with financial advisors who specialize in various fields.

Based on their financial objectives and risk tolerance, these experts may offer investors tailored insights and methods to assist them in making wise selections. Furthermore, in order to preserve equilibrium and maximize performance, diverse portfolios need ongoing monitoring and modification—tasks that financial advisors excel at.

Investors can achieve more stable and prosperous long-term investment results by navigating difficult challenges, taking advantage of opportunities, and managing risks in their diverse portfolios with the help of a professional.

Also Check:

Conclusion

In conclusion, diversity is a key tactic for optimizing returns and successfully controlling risk in an investing portfolio.

Investors can reduce market volatility and specific investment risks by distributing their assets over a variety of asset classes, industries, geographical areas, firm sizes, and timeframes.

This strategy improves portfolio resilience and stability over time, while also safeguarding capital during recessions.

By reducing potential losses and taking advantage of different market possibilities, diversification helps investors achieve their financial goals through a sustainable and well-balanced investment plan.

FAQs related to diversification in your investment portfolio

It is most important because, in unpredictable times, diversification can lower losses and increase returns. Since different assets behave differently in different market conditions, you can reduce overall losses by spreading your investments over a variety of assets. For older investors who are getting close to retirement, this is especially crucial in order to safeguard their savings.

By the reference of Quizlet, Diversification is important because of it can improve returns and reduce losses during uncertain times. By spreading investments across different assets, you minimize overall losses since different assets perform differently under various market conditions. This is especially important for older investors nearing retirement to help protect their savings.

When the market for a particular product becomes saturated, a diversification strategy helps a business reach new customers, spread investments to lower risks, increase competitiveness by providing a wider range of goods or services, and improve stability by lowering dependence on a single product or market.